While China has the advantage of cheap electricity, the United States is easily accessible to capital and legally stable, which makes mining bitcoin here just as attractive.

When it comes to the power and capital benefits of cryptocurrency mining, people often think of China, which accounts for 65% of the world’s mining power. But in terms of other measures in cryptocurrencies, the hashrate originating in the United States is increasing at a breakneck rate.

This is a strange phenomenon, because the United States and Canada are not countries with the cheapest electricity prices in the world. However, these are places where there are many unused sources of electricity and plentiful electrical infrastructure to reuse. However, the decisive factor for this comes from the stability and ease of access to capital markets and institutional investors.

There are currently at least 23 publicly traded crypto mining companies, most of which are from the United States and Canada.

“The US stock market continues to be the most preferred place for crypto miners,” said Ethan Vera, chief financial officer and co-founder of cryptocurrency miner Luxor Technologies. “They can raise capital through product offerings in the market, creating a strong financial approach for public companies looking to expand their business. Foreign companies have financial leverage. More restrictions will make it more difficult to raise equity capital.

Meanwhile, Chinese cryptocurrency miners face stark contrast. Although mining of cryptocurrencies is legal in China, their trading is prohibited. It is difficult for operators to access bank loans, let alone quote stocks to raise capital. This forced them to seek loans outside the banking system to keep their business going.

Difficulties in raising investment capital also limit operators if they wish to expand mining, even though China is one of the major manufacturers of specialized Bitcoin mining machines.

Decentralization in Bitcoin mining

Therefore, although China still maintains a dominant position in cryptocurrency mining thanks to cheap labor and abundant hydropower, Chinese companies have started to pay attention to the United States. United when they want to diversify. Diversify their investments.

According to Peter Wall, CEO of Argo Blockchain, a company listed on the London Stock Exchange: “Over the past few months, I’ve been talking to people in the crypto industry about how Chinese miners are doing. has been discussed for the past few years, but now this is actually a trend that we are seeing. Operators are always looking for more stability, what the North American market is offering and The cost of doing so. Electricity as well as power plant construction in North America are also quite competitive and sometimes even inferior to China. “

Not only does this mean that at some point the United States could overtake China in this nascent field, but in turn, it will further decentralize the cryptocurrency mining market – an important factor for this market.

Mike Colyer, CEO of Foundry, a crypto mining investment firm, said, “The goal is not for America to dominate bitcoin mining. It won’t happen. The goal here is to decentralize. Middle of the world. “

“Much of the electricity in the United States is abandoned by regulation, and hedge funds and private companies have lots of power generation facilities. Colyer said. “They are starting to realize that they can make a lot of money from bitcoin mining and make power generation in general more efficient. They can save money through their baseload power generation. ” I can also make money with bitcoin. “

Bitcoin power station and mining center

The combination of smart investment and energy innovation has been demonstrated by Greenidge Generation, a natural gas-fired power plant located in upstate New York. Its owner, Atlas Holdings, turned the facility into a cryptocurrency mining hub earlier this year.

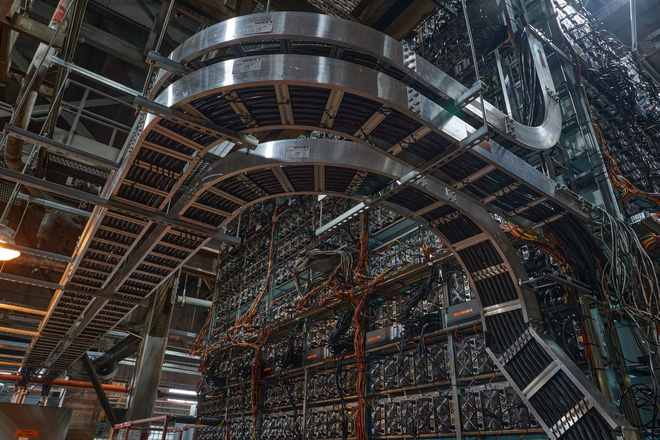

Bitcoin mining facility at the Greenidge plant – on average this facility generates around 5.5 BTC per day

Greenidge is a combined facility, which means that bitcoin mining will improve the stability of the power grid here. Connecting to the Millennium Pipeline power grid, a highly liquid direct electricity market, also helps Greenidge eliminate input fluctuations for years to come.

Tim Rainey, Chief Financial Officer of Greenidge, said: “25% of our total capacity is dedicated to cryptocurrency mining. The rest will be sent over the network as needed. Before we mine Bitcoin, we will send it over the network. hours to start up and power the grid in times of high demand, but now we can add up to 100 megawatts of electricity in an hour, which adds more stability to the grid, the grid is like bitcoin mining. “

These benefits help the United States and Canada capture 15-20% of the world’s cryptocurrency mining power. The rest belong to countries like Russia, Kazakhstan and the Nordic countries. There are currently around 15 mining facilities over 50 MW in North America, according to estimates by Taras Kulyk, vice president of Core Scientific, America’s largest cryptocurrency operator.

“Operating costs are a bit more expensive in the United States, but when you pour $ 100 million or even a billion dollars into a crypto-mining infrastructure ecosystem, you need stability. Kulyk said.